On December 17, 2025, the EdTech landscape shifted permanently. Coursera (NYSE: COUR) and Udemy (NASDAQ: UDMY) announced a definitive merger agreement valued at approximately $2.5 billion. This all-stock transaction unites two industry giants that had previously pursued opposite strategies: Coursera’s “ivory tower” academic partnerships and Udemy’s “town square” open marketplace.

In this article

This case study analyzes the strategic logic behind the deal, the financial mechanics of the 0.800 exchange ratio, and the existential threat of Generative AI that forced these former rivals to join forces.

Deal at a glance

2.5

0.8

59

41

Strategic Rationale: The “Barbell” Strategy Behind the Coursera Udemy Merger

1- Completing the Content Spectrum

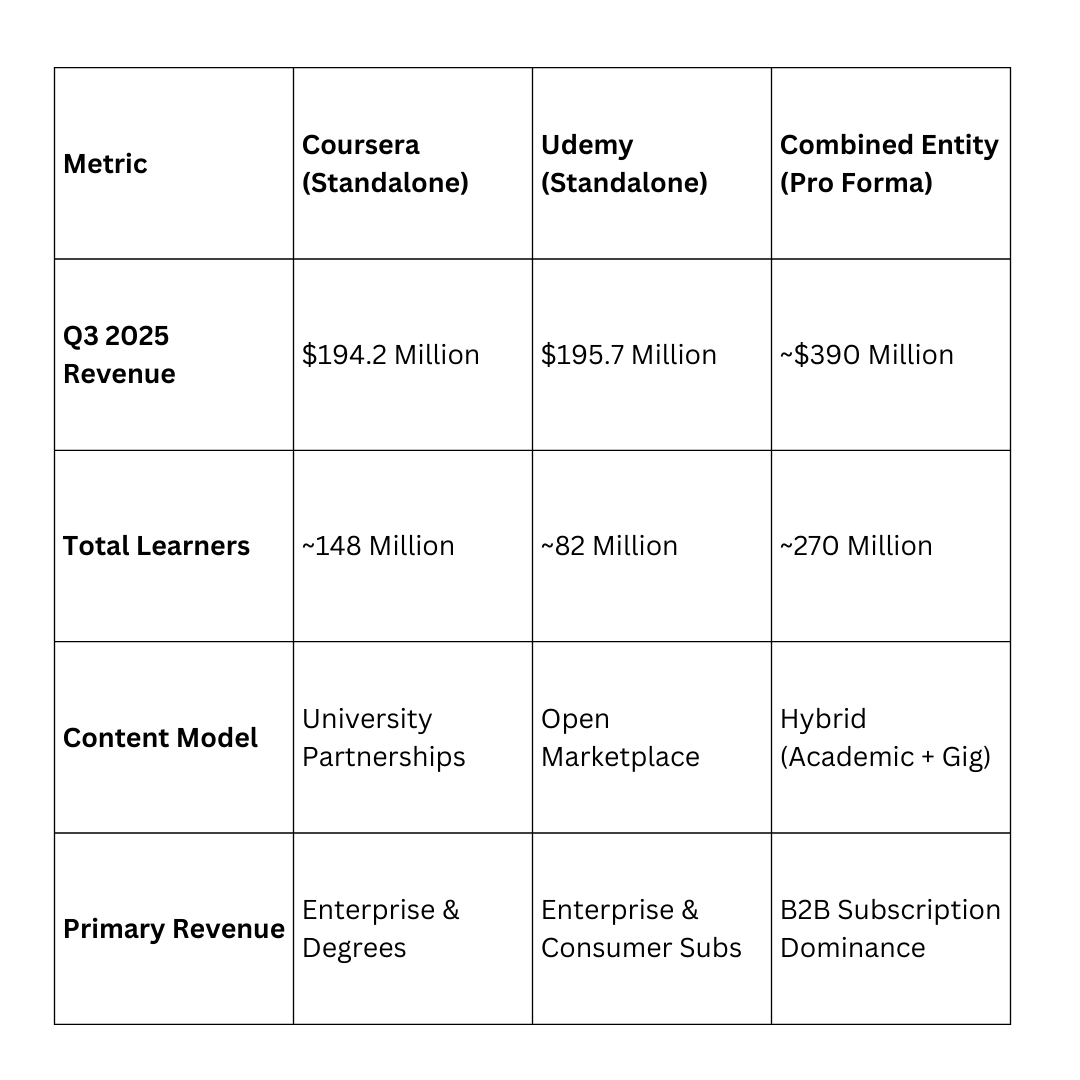

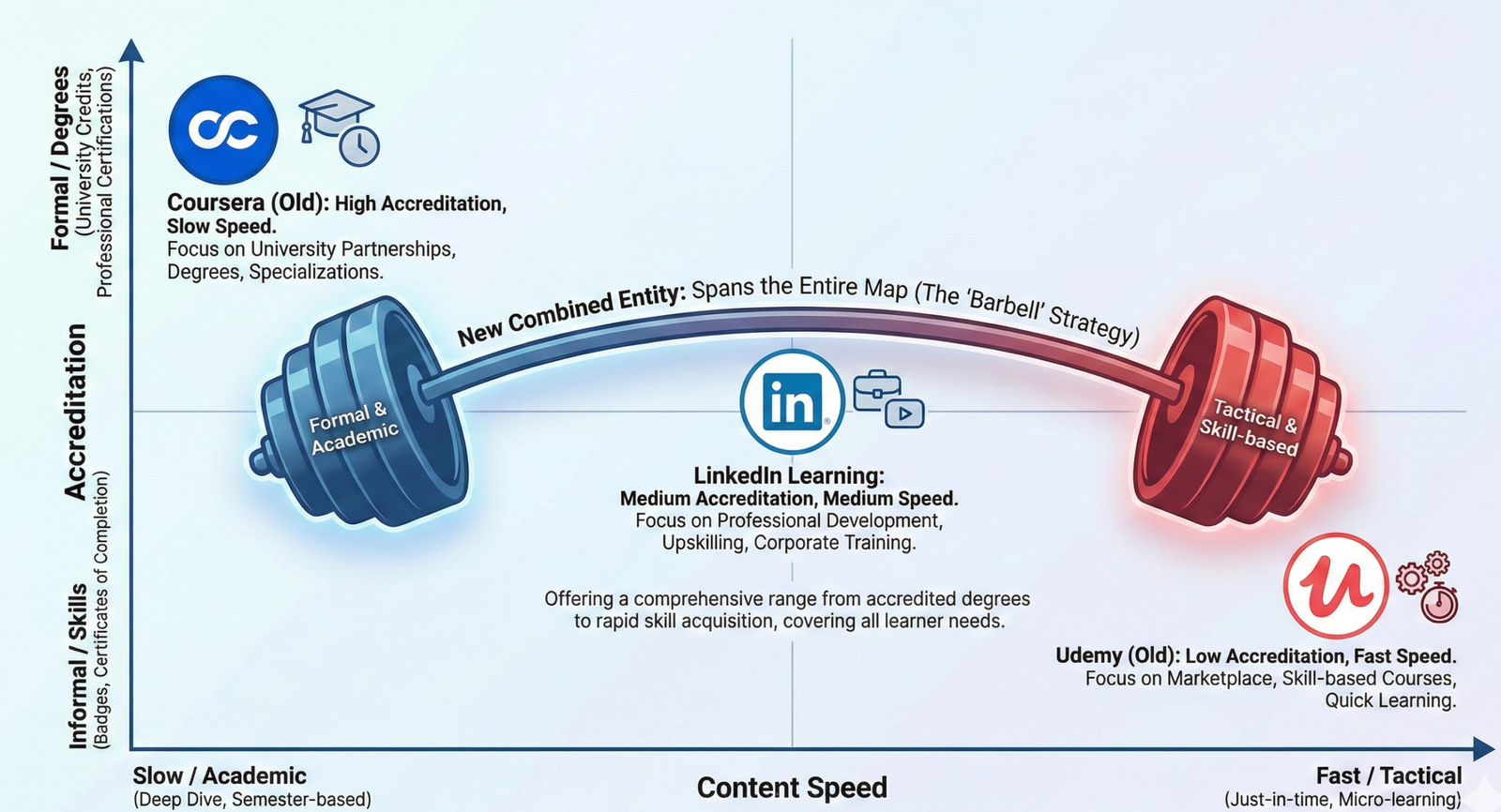

Coursera has historically dominated the high-end market: accredited degrees, university certificates, and long-form academic courses. However, producing this content is slow. Udemy dominates the agile skills market: short, tactical courses (e.g., “How to use ChatGPT 5.0”) created by independent instructors.

The Synergy: The combined entity offers a “barbell” product agile skills for immediate needs (Udemy) and accredited credentials for long-term career growth (Coursera).

2- The B2B Enterprise Play

The real prize is the corporate learning budget. Large enterprises suffer from “vendor sprawl,” paying for multiple learning platforms. By merging, the new entity can offer a single contract covering everything from coding bootcamps to executive MBAs, effectively boxing out competitors like LinkedIn Learning and Pluralsight.

3- The AI Catalyst: Defending Against “Free”

Generative AI was the silent broker in this deal. As AI models like GPT-5 become capable of teaching coding or writing marketing copy in real-time, the value of static video courses drops.

The Data Moat: By combining Coursera’s academic data with Udemy’s 82 million learners and 250,000+ courses, the new company gains a massive proprietary dataset. This data is essential for training the next generation of “AI Tutors” that can offer personalized, real-time coaching—something a generic AI model cannot easily replicate without access to structured curriculum data.

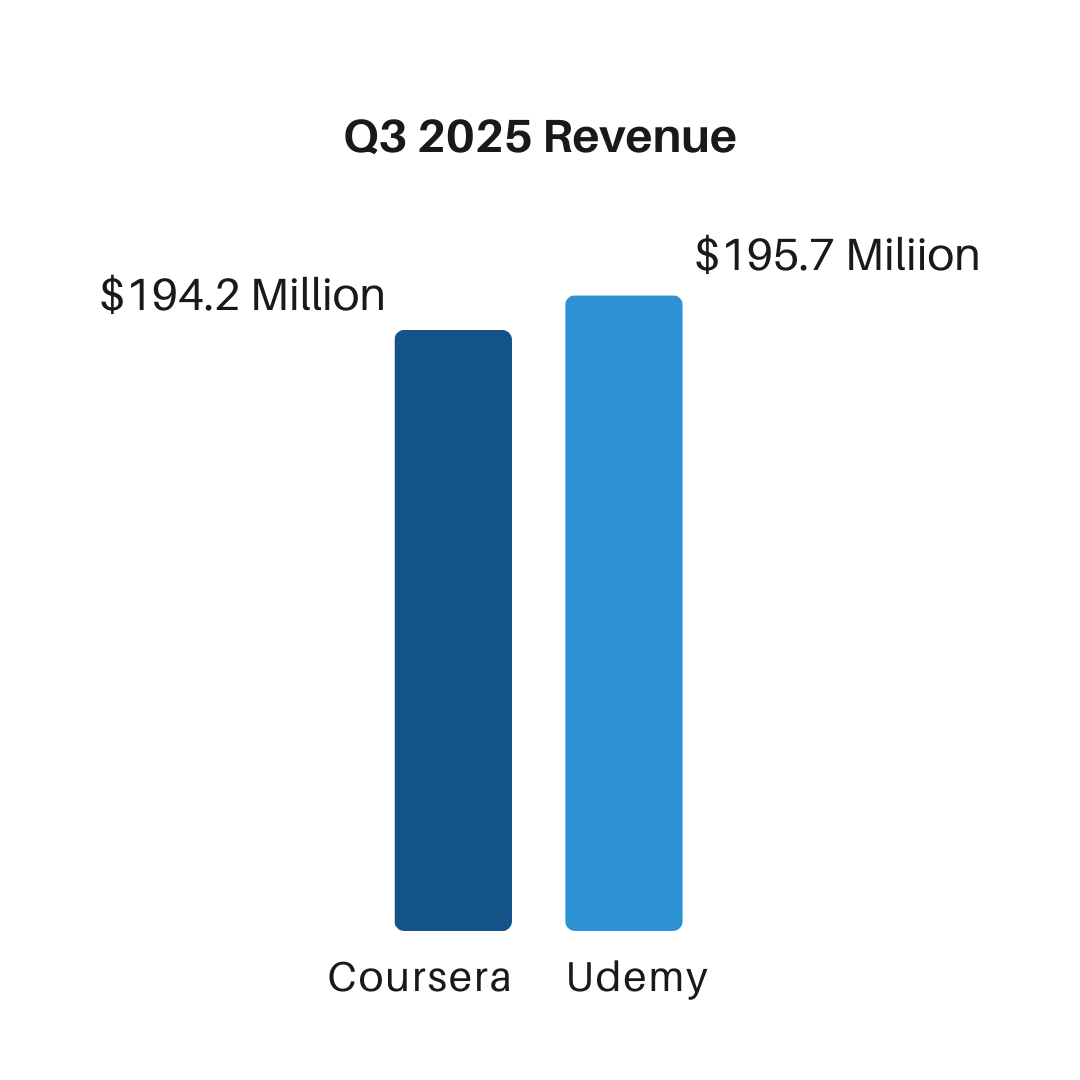

The transaction is structured as an acquisition of Udemy by Coursera, though the financials suggest a merger of near-equals

Are they Too Big to Fail?

The Coursera-Udemy merger is a defensive fortification against a changing world. By becoming the largest “Skills Operating System” globally, the combined company hopes to survive the AI disruption that is rendering traditional online courses obsolete. Success will depend less on the financial engineering of the deal, and more on whether they can integrate two vastly different cultures without destroying the communities that built them.

What the Coursera Udemy Merger Means For Learners And Enterprises

This perspective reflects my ongoing work in enterprise learning strategy, leadership development, and AI-enabled capability building for organizations navigating digital transformation.

The market response was polarized.

- Udemy (Target): Shares surged ~22-28%, closing the valuation gap.

- Coursera (Acquirer): Shares fell ~11%, reflecting investor skepticism about the difficulty of integration and dilution of equity.

Competitor Watch:

- LinkedIn Learning: Remains the biggest threat due to its integration with Microsoft’s ecosystem.

Below is my perspective on the evolving EdTech landscape, illustrated through an AI-generated visual representation.

Future Outlook: Will the Coursera Udemy Merger Reshape EdTech?

The Coursera Udemy merger may redefine how learning platforms balance depth with speed. As AI-driven personalization becomes central to learning design, platforms that combine structured credentials with rapid skill acquisition will gain an edge in enterprise adoption.

From a broader industry perspective, the Coursera Udemy merger is likely to accelerate consolidation across the EdTech sector. Smaller platforms may be forced to specialize deeply, partner with larger ecosystems, or exit altogether as scale, data, and AI-driven personalization become decisive competitive advantages.

For learners, this consolidation could mean fewer platforms but richer learning pathways, moving seamlessly from tactical skills to accredited programs. For organizations, it offers a unified ecosystem for continuous upskilling, leadership development, and role-based learning at scale.

However, consolidation also raises questions around content diversity, pricing power, and the survival of niche EdTech providers. The long-term success of this merger will depend on execution, how effectively academic rigor and marketplace agility are integrated without diluting either.

This analysis is part of my broader work at the intersection of technology, strategy, and learning, where I explore how platforms, organizations, and individuals adapt to large-scale digital change.